July 2024

How is the Real Estate Market Affected During Election Years?

-

Market Uncertainty: During election periods, uncertainty about future policies can lead to cautious consumer behavior. Buyers and sellers may postpone decisions until after the election to assess potential impacts on taxes, regulations, and economic stability.

-

Interest Rates: The Federal Reserve typically maintains a stable approach to interest rates during election years to avoid perceptions of political influence. This stability can provide a favorable environment for borrowing and real estate investment, though any signals of future rate adjustments post-election can influence market sentiment.

-

Policy Proposals: Candidates often propose changes to housing policies, tax incentives, and economic regulations. Speculation on these proposals can affect market sentiment and strategic decisions by investors and homeowners alike. Adjustments in mortgage interest deductions, property taxes, and housing subsidies can particularly influence real estate market dynamics.

-

Stock Market Volatility: Elections frequently coincide with fluctuations in the stock market. Investors may seek more stable assets such as real estate during times of stock market volatility, potentially increasing demand in the property market. Conversely, significant downturns in the stock market can reduce liquidity available for real estate investments.

-

Regional Impacts: The impact of election cycles on real estate markets can vary significantly by region. Areas with economies heavily reliant on federal spending or policies may experience more pronounced effects. Local elections and ballot measures can directly influence property taxes, zoning laws, and infrastructure spending, shaping local market conditions.

-

Post-Election Dynamics: Once election results are clear, the real estate market often experiences a rebound in activity. Clarity on future policies and economic direction can restore confidence among buyers and sellers, leading to increased transactions and market stability.

Let's talk about it. 623-332-7497

June 2024

4 Things to Consider If You’re Waiting to Sell Your House until after the Real Estate Settlement Takes Effect

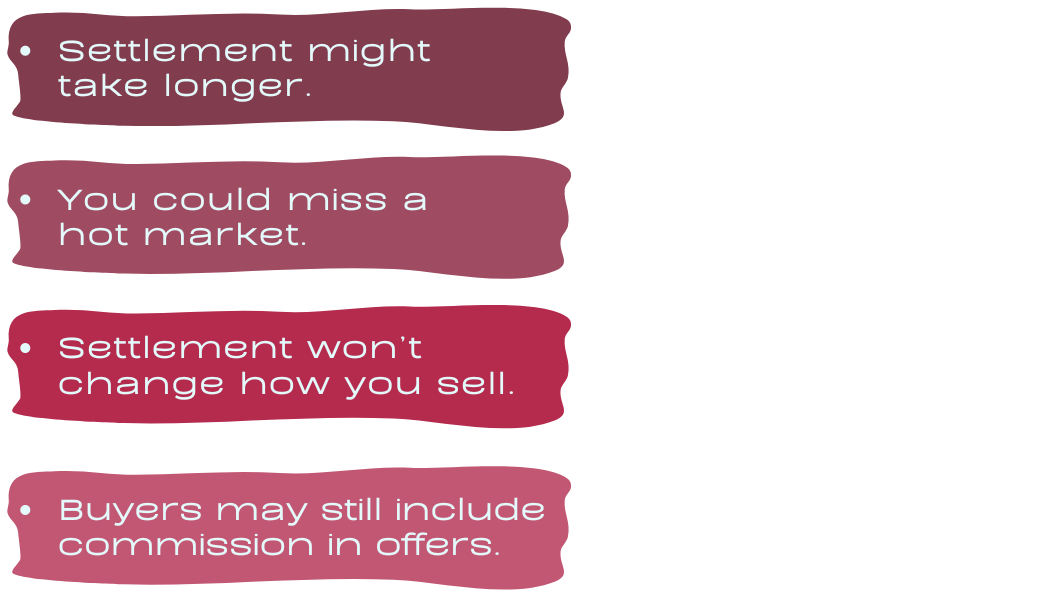

If you’re thinking about selling your house this year, you might be wondering if it makes sense to wait until after the recent commission lawsuit settlement takes effect so you can avoid paying a commission to a buyers’ agent.It’s understandable, considering it probably sounds like just waiting a few months will net you thousands of dollars — or maybe even tens of thousands — when you sell your house.But before you bank on that and hit the pause button on selling your house, here are 4 things to think about:

1) It Might Not Be Just a Few Months

While the settlement is proposed to take effect in July 2024, keep in mind that the key word is “proposed.” CNBC recently reported that because it’s a federal class-action lawsuit, there will be a period of review and time for commentary and feedback to be given by any interested parties, which could make the end of the year a more realistic timeframe for changes to take effect.

2) You Could Miss out on a Hot Market

According to Yahoo Finance, a recent survey revealed that 79% of sellers already regret missing the hottest market in decades, and wish they’d sold their home sooner. While it may be true that home prices have softened in some areas, prices are still historically high right now in most areas and price ranges.It’s impossible to predict when or if there will be a major price correction, and it may not happen in the next few months, or even a year. But considering how the majority of home sellers already feel about slightly lower prices, think about how you’d feel if you waited and realized prices were much higher currently, especially if they dropped more than you were trying to save by avoiding paying a commission to a buyers’ agent.

3) It Might Not Change How You Choose to Approach Selling

Nothing in the proposed settlement says that you can’t continue to offer a commission split to buyers’ agents. You’ll still be allowed to do so, it just won’t be published within the MLS listing. And, for many sellers, there’s a good chance that doing so will be a smart, strategic way to get their home sold as quickly, and for the highest amount possible, by exposing their home to the entire market as efficiently as possible.

4) You Might Find That Buyers’ Offers Include Commission

Many buyers will still be represented by buyers’ agents once the settlement takes effect. Even though the proposed settlement allows sellers to not offer a buyers’ agent commission (which has always been the case, actually), and requires that buyers sign an agreement with their agent which will include how much their agent will be paid, it doesn’t mean that buyers won’t want to negotiate it into the agreed upon purchase price.If you aren’t open to considering offers from buyers who do so, you’ll be limiting your options, and possibly how much you can sell your house for. And any unrepresented buyers may want to discount how much they offer you by deducting what they consider to be how much their agent would’ve been paid anyway, so your net proceeds may be fairly similar whether your buyer is represented or not.

Don't miss these

2024 Selling Surge: Why Now Is the Time to Sell Your House

Springtime brings with it the promise of renewal and growth, and for homeowners contemplating selling their houses, it offers a golden opportunity. The real estate market in 2024 is witnessing a surge in selling activity, making it an ideal moment to list your property. Here's why.

Firstly, let's talk about inventory. Compared to last year, there has been a noticeable rise in the number of houses up for sale. This increase translates to more choices for potential buyers scouring the market for their dream home. However, despite this uptick, there remains a scarcity of available properties in many areas. This scarcity means that your house, among the increased inventory, is likely to stand out. Imagine your property nestled among fewer options for buyers to consider. It's like being a prized jewel in a collection—a standout amidst the crowd. With less competition, your house gains a distinct advantage. It's not just another listing lost in the sea of available homes; it's a beacon drawing in potential buyers with its unique allure.

In such a scenario, your property isn't just another option—it becomes the option. Buyers, faced with limited choices, are more likely to take notice of your listing, giving you an edge in attracting attention and, importantly, receiving competitive offers. Your house garners more interest, driving up its perceived value and increasing the likelihood of securing a favorable sale price.

The combination of increased inventory and limited competition creates an optimal environment for sellers. It's a seller's market, where your house has the spotlight it deserves. This favorable landscape not only enhances your property's visibility but also expedites the selling process. With fewer alternatives for buyers to deliberate over, decisions are made swiftly, potentially leading to a quicker sale.

If you've been toying with the idea of selling your house, now is indeed the opportune moment to seize. The stars have aligned, and market conditions are in your favor. Don't let this window of opportunity pass you by.

Of course, navigating the intricacies of selling a house can be daunting. That's where the expertise of a real estate professional comes in. When you're ready to take the plunge, reaching out to discuss your options with a knowledgeable agent can provide invaluable guidance. From setting the right price to staging your home for maximum appeal, they'll help kickstart the process and ensure a smooth transition from listing to closing.

In conclusion, the 2024 selling surge presents an advantageous climate for homeowners looking to sell their properties. With increased inventory and limited competition, your house has the chance to shine in the market, potentially leading to a quicker sale at a favorable price point. So, if you've been contemplating selling your house, there's no time like the present to make your move and capitalize on these favorable market conditions.

May 2024

Should I Move with Today’s Mortgage Rates?

When mortgage rates spiked up over the last few years, some homeowners put their plans to move on pause. Maybe you did too because you didn’t want to sell and take on a higher mortgage rate for your next home. But is that still the right strategy for you?

In today’s market, data shows more homeowners are getting used to where rates are and thinking it may be time to move. As Mark Zandi, Chief Economist at Moody’s Analytics, explains:

“Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly coming to the realization that mortgage rates aren’t going back anywhere near the rate on their existing mortgage.”

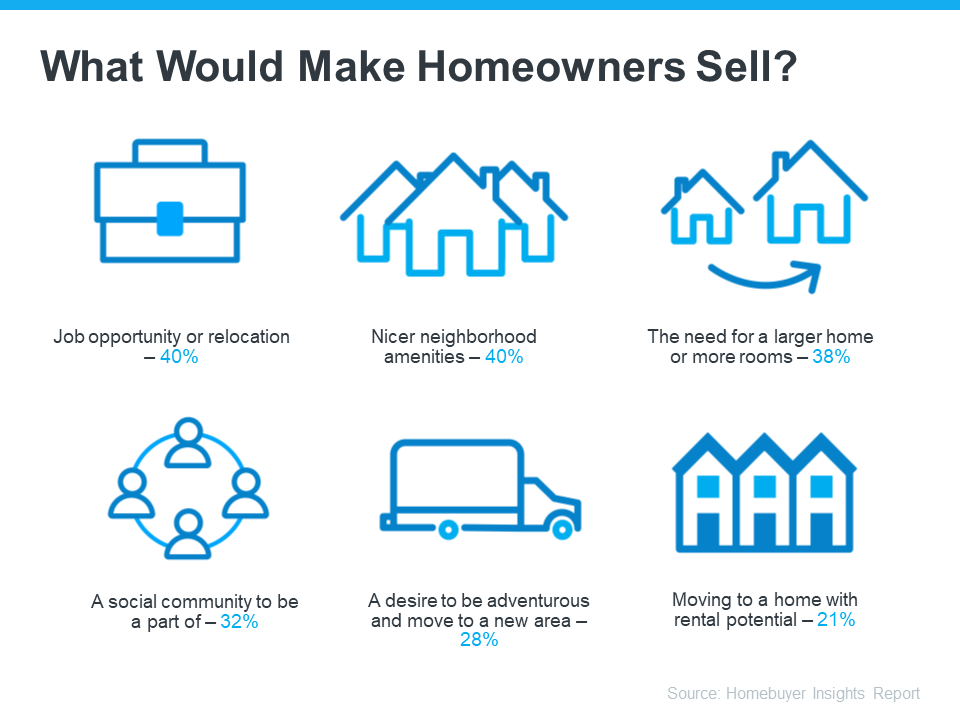

A recent study from Bank of America sheds light on some of the things homeowners say would make them sell, even with rates where they are right now (see visual below):

What Would Motivate You To Move?

Now that you know why other people would move, take a minute to think about what would make a move worth it for you. Is it time to take a chance and go for your dream job, even though it’s not local? Are you looking for a neighborhood that has more to offer and a close-knit sense of community? Maybe you just need more space, you’re looking for your next great adventure, or you want a house that opens up rental opportunities to pad your income.

And here’s something else to consider. Mortgage rates are still expected to go down over the course of the year. And once that happens, there’s going to be a big rush of buyers jumping back into the market. While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

So, does that mean it’s worth it to move now, even with rates where they are? The answer is: that it depends.

You'll want to consider today’s mortgage rates, where they’re expected to go from here, and what would prompt you to want to make a change as you decide on your next steps. An expert can help with that.

Bottom Line

Other homeowners are getting used to rates and deciding to move. Let’s chat to go over what matters most to you and if it’s time for you to jump back into the market too.

What You Really Need To Know About Home Prices

According to recent data from Fannie Mae, almost 1 in 4 people still think home prices are going to come down. If you’re one of the people worried about that, here’s what you need to know.

A lot of that fear is probably coming from what you’re hearing in the media or reading online. But here’s the thing to remember. Negative news sells. That means, you may not be getting the full picture. You may only be getting the clickbait version. As Jay Thompson, a Real Estate Industry Consultant, explains:

“Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content, has been an issue since the dawn of the internet, and housing news is not immune to it.”

Here’s a look at the data to set the record straight.

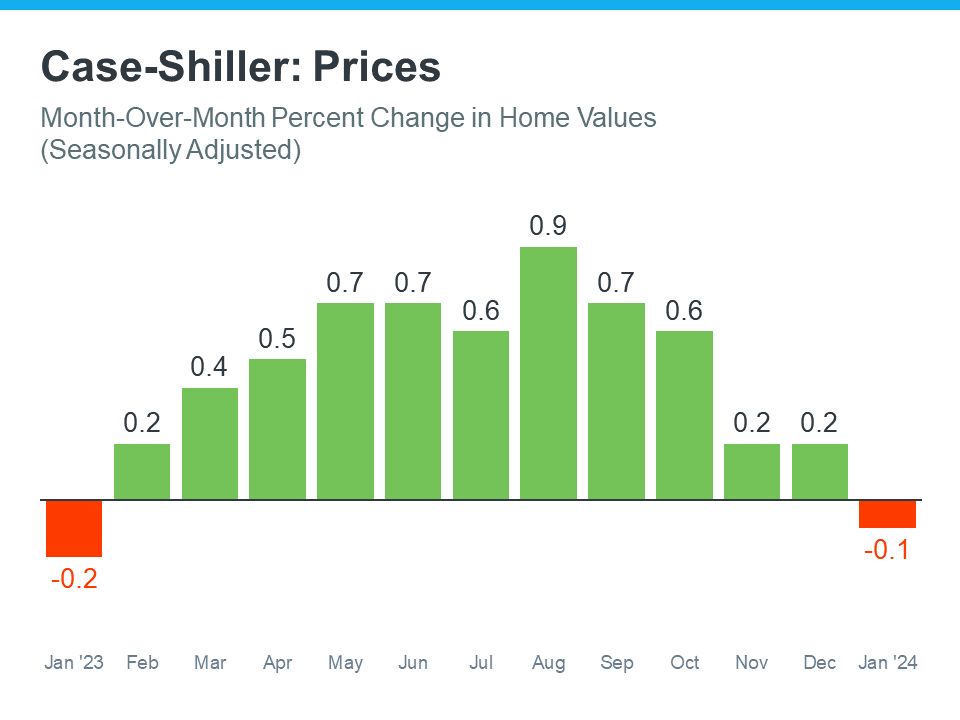

Home Prices Rose the Majority of the Past Year

Case-Shiller releases a report each month on the percent of monthly home price changes. If you look at their data from January 2023 through the latest numbers available, here’s what you’d see:

What do you notice when you look at this graph? It depends on what color you’re more drawn to. If you look at the green, you’ll see home prices rose for the majority of the past year.

But, if you’re drawn to the red, you may only focus on the two slight declines. This is what a lot of media coverage does. Since negative news sells, drawing attention to these slight dips happens often. But that loses sight of the bigger picture.

Here’s what this data really says. There’s a lot more green in that graph than red. And even for the two red bars, they’re so slight, they’re practically flat. If you look at the year as a whole, home prices still rose overall.

It’s perfectly normal in the housing market for home price growth to slow down in the winter. That’s because fewer people move during the holidays and at the start of the year, so there’s not as much upward pressure on home prices during that time. That’s why, even the green bars toward the end of the year show smaller price gains.

The overarching story is that prices went up last year, not down.

To sum all that up, the source for that data in the graph above, Case Shiller, explains it like this:

“Month-over-month numbers were relatively flat, . . . However, the annual growth was more significant for both indices, rising 7.4 percent and 6.6 percent, respectively.”

If one of the expert organizations tracking home price trends says the very slight dips are nothing to worry about, why be concerned? Even Case-Shiller is drawing your attention to how those were virtually flat and how home prices actually grew over the year.

Bottom Line

The data shows that, as a whole, home prices rose over the past year. If you have questions about what’s happening with home prices in our area, let's chat.